Investors have become more demanding.

To get funded, your startup has to stand out as an attractive investment opportunity.

Today’s investors expect well-prepared founders, a compelling pitch as well as a clear view on market size, financials and KPIs.

Analysis within our Investor Readiness Framework: Together, we analyse your startup as well as everything you’ve prepared for your fundraising so far.

We locate improvement potentials in your pitch, case positioning, financial model, market sizing, cap table and fundraising strategy.

We execute on improvement potentials giving guidance on all questions you might have along the way.

We identify suitable investors that are likely to be interested in your startup.

At the end of the program, you understand what really matters for startup fundraising and are perfectly prepared to enter the fundraising process confidently.

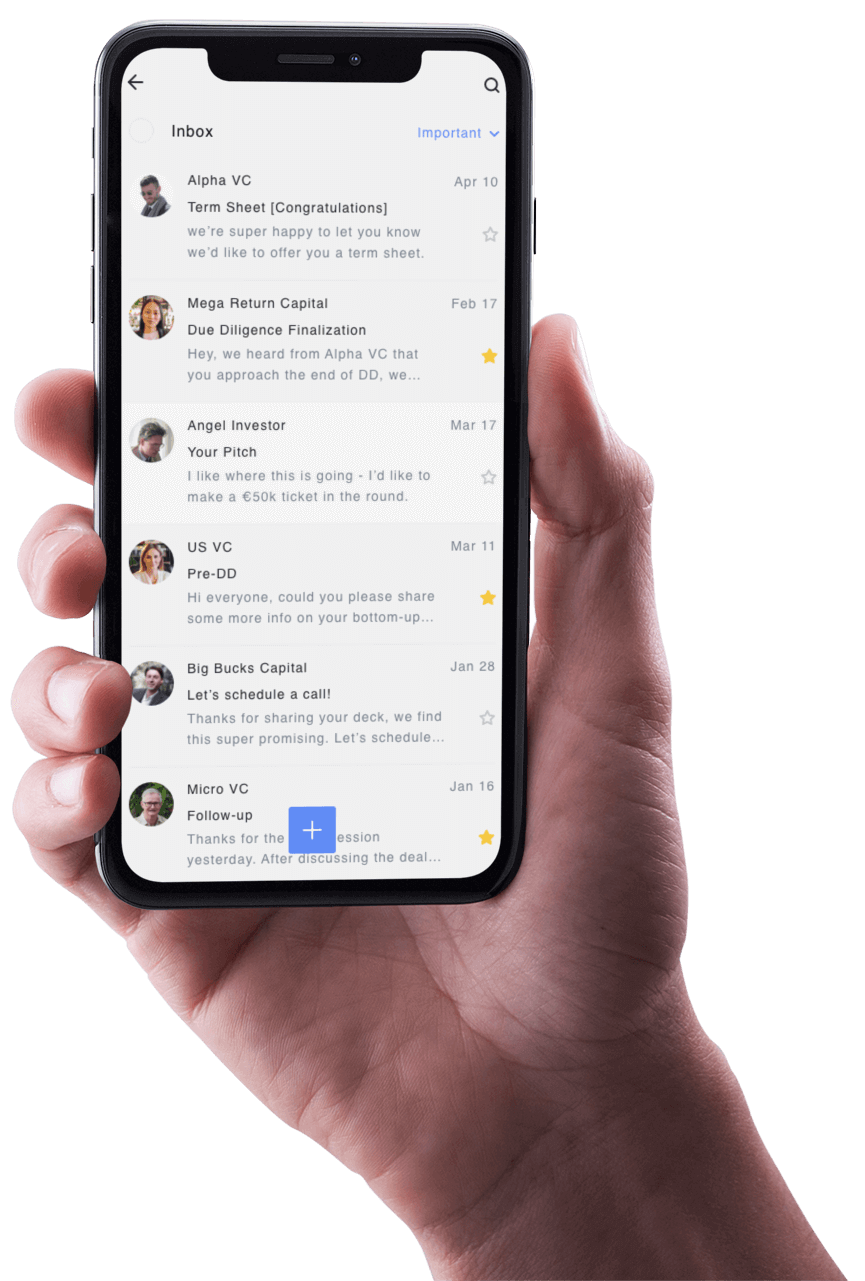

Congratulations, this is a fantastic pitch deck. Before I dive deeper, could you let me know the terms of the round? All the best!

Business Angel with successful IPO (Ex Rocket Internet)

That sounds good. We have good feedback regarding our last pitch meeting: We’re in with €500k!

Early-stage VC

We can give you feedback quicker than we originally expected. We would be happy to schedule a meeting with you this week Thursday to pitch – we’d love to hear back from you!

Micro-VC

Good to connect. Congrats on your traction so far, this sounds super promising. Let’s schedule a Call for next week.

Business Angel with successful Exit to DAX company

Our founder-friendly pricing model ensures you get support from venture finance professionals at an affordable price.

We help you craft your fundraising storyline into a powerful pitch deck, ready to convince investors.

We take a deep dive into your financials, ensuring your calculations add up for investors.

We support you in all aspects of investor readiness, incl. pitch deck, financials and sparring sessions.