Raise equity from investors that suit you. With experts, proven strategies and hands-on support.

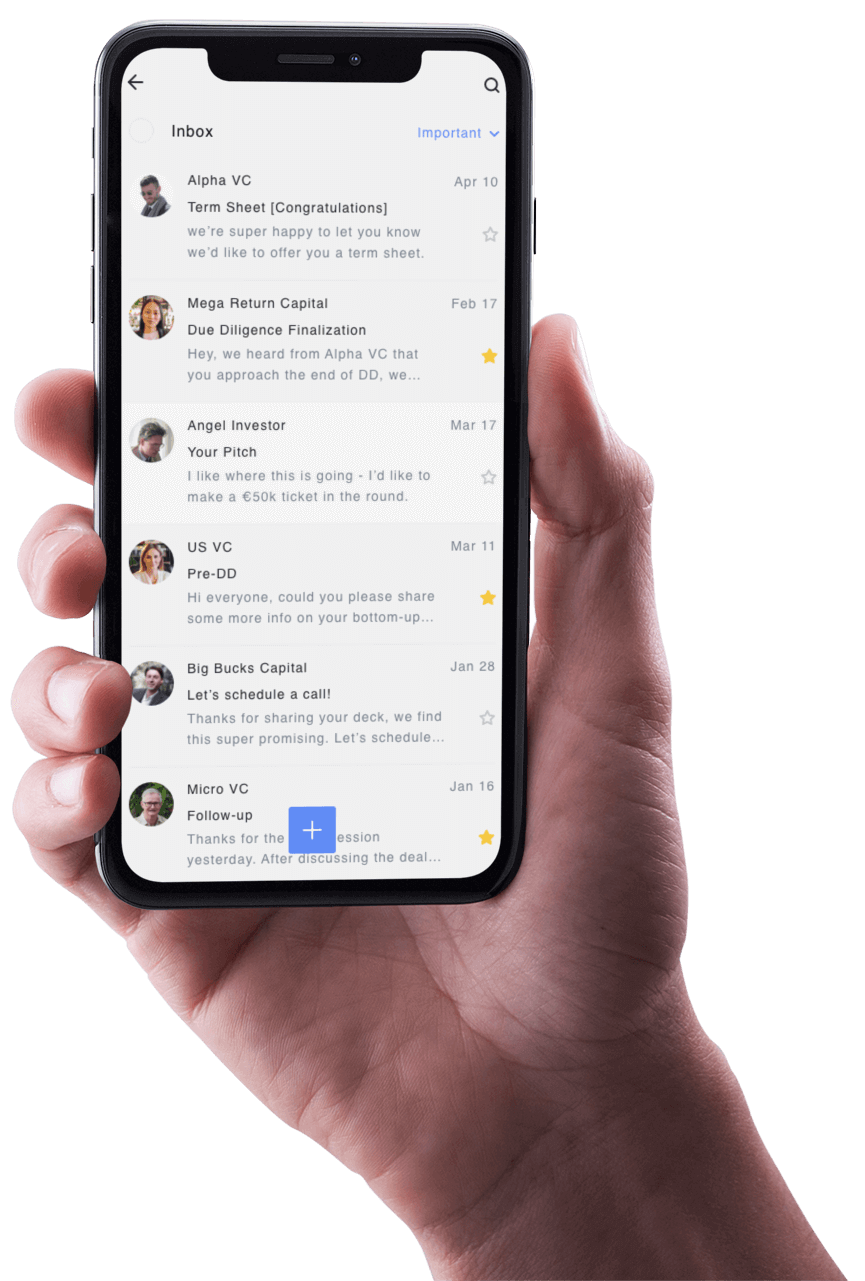

Congratulations, this is a fantastic pitch deck. Before I dive deeper, could you let me know the terms of the round? All the best!

Business Angel with successful IPO (Ex Rocket Internet)

That sounds good. We have good feedback regarding our last pitch meeting: We’re in with €500k!

Early-stage VC

We can give you feedback quicker than we originally expected. We would be happy to schedule a meeting with you this week Thursday to pitch – we’d love to hear back from you!

Micro-VC

Good to connect. Congrats on your traction so far, this sounds super promising. Let’s schedule a Call for next week.

Business Angel with successful Exit to DAX company

We structure your fundraising process in 4 stages, so you don’t waste time in getting funded.

A well-prepared fundraising process is key to maintain momentum and convince VCs, Business Angels and strategic investors. We analyse your equity story, pitch deck, market sizing, financials, valuation, KPIs and competitors to craft the perfect fundraising strategy for your startup. We prepare all key documents using best practices to ensure they provide a compelling and coherent story for investors.

We create a strong investor pipeline of at least ~100 suitable investors, many with the opportunity to provide warm, personal introductions. We cluster the investors into cohorts of various priorities to ensure iteration opportunities, fine-tuning the pitch along the way. We keep track of the pipeline for you, support your outreach, draft investor updates and communicate a clear timeline for your fundraising process.

We help you focus on what matters during due diligence. We provide guidelines on content and structure of the dataroom, help you fill the dataroom, prepare session decks and answer investor questions.

The day has come, you have received multiple term sheets. We help to coordinate all parties involved, from co-investors to lawyers. We support your negotiation and make sure the process of signing and closing is running smoothly. Congratulations, your startup is funded!

Working with Venture Advisory Partners means raising capital on terms that work for you.

Everything you need to convince investors

10-12 Slides Main Deck +

0-10 Slides Appendix

Operating Model, P&L, Cashflow Model, Financing Need, Use of Funds

See how other startups have fast-tracked their fundraising with Venture Advisory Partners.

“The Venture Advisory Partners Team has played a crucial role in making our pre-seed financing round happen. They supported us hands-on every step of the way, from figuring out our funding case to having our backs in Due Diligence. I would highly recommend working with Venture Advisory Partners for your fundraising.”

Enterprise SaaS

Pre-Seed

“Our collaboration with Peter from Venture Advisory Partners was super goal oriented and professional. We had a fantastic and insightful kick-off. In record time, Peter managed to identify the most relevant KPIs and structure our business case. From creating our financial model to approaching investors and closing the deal, Venture Advisory Partners was at our side and felt like a Co-Entrepreneur the whole time. We’re happy to continue our collaboration with Venture Advisory Partners to realize our vision of becoming Europe’s leading van sharing startup!”

Mobility

Pre-Seed